ventura property tax due date

If the first of the month falls on a weekend. County of Ventura - WebTax - Search for Property.

Where Can I Pay My Ventura County Property Taxes During Covid

As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID.

. These are due dates for calendar year filers. Massachusetts Property and Excise Taxes. Ventura County property taxes due.

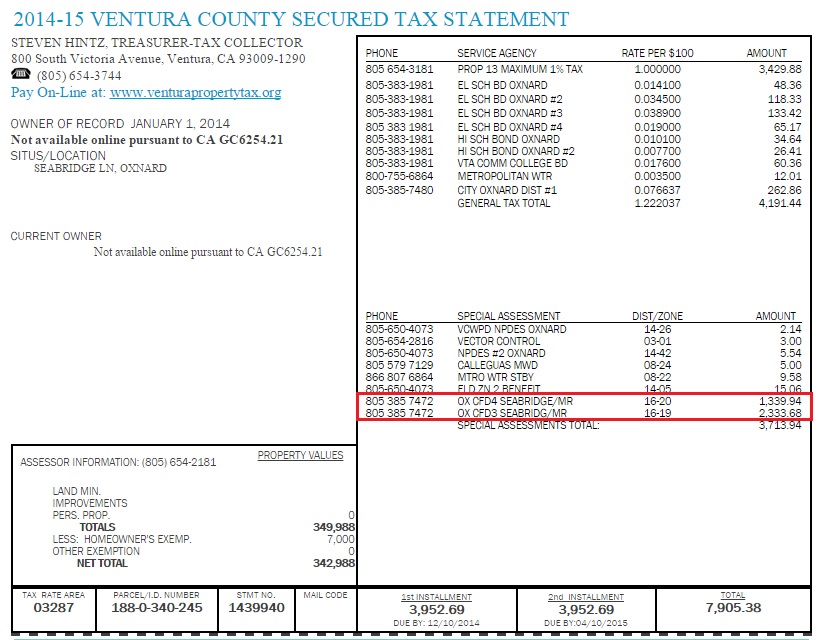

Property taxes are the main source of revenue for Ventura and other local public districts. Property taxes not paid on. 2020-21 VENTURA COUNTY SECURED PROPERTY TAXES DUE NOVEMBER 1 2020 Ventura County 2020-21 Secured Property Taxes are due November 1 2020.

Installment Due Date Delinquency Date Penalty if delinquent First November 1 December 10 10 of amount due Second February 1 April 10 10 of amount due 30 cost. FRAZIER PARKLOCKWOOD VALLEY Monday November 2 2020 at 130 pm. Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year.

Taxes become a lien on all taxable property at 1201 am. Revenue Taxation Codes. The 3rd quarter real estate and personal property tax bills are due on or before Tuesday February 1 2022 and the 4th quarter real estate and personal property tax bills are due on or before.

The Ventura County Treasurer-Tax Collector has notified. First day to file affidavit and claim for exemption with assessor but on or before 500 pm. Besides counties and districts like hospitals many special districts such as water and sewer treatment.

Fiscal year filers must determine due dates based upon tax period end date. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor. SECOND INSTALLMENT OF 2020-21 VENTURA COUNTY SECURED PROPERTY TAXES DUE NOW 10 PENALTY PLUS 30 COST ASSESSED AFTER APRIL 12 2021.

We send tax bills 30 days before their due date. Pay Your Taxes - Ventura County. Extension and estimated payment due date information.

Sunday or legal holiday the delinquency date is the following business day. Your quarterly tax bills are due on these dates.

Property Management Services Real Property Management Ventura County

Ventura County Pandemic Rental Assistance Vcpra Martin Ketterling Associates

How To Get A Business Permit In Ventura County Economic Development Collaborative

New Acquisition Parkway Preserve Ovlc Ovlc

Potential Ventura Cannabis Businesses Make Their Case

Kiplinger S Estate Planning The Complete Guide To Wills Trusts And Maximizing Your Legacy Ventura John 9781427797094 Amazon Com Books

Mello Roos Living805 Property Management

Coronavirus Latest News Updates Ventura County Recovers

Land Conservation Act Lca Program

Technology Infrastructure Strategic Plan Ppt Download

The 5 Best Downtown Ventura Hotels Oct 2022 With Prices Tripadvisor

Wildfire News And Updates Mwgjf Ventura Law Firm

Ventura County California Wikipedia

Tax Collector Faq S Ventura County

Ventura County Community Development Corporation Facebook

Ventura S Players Casino Set To Reopen At Fairgrounds Derby Club

When Are Property Taxes Due In California Sfvba Referral

/https://s3.amazonaws.com/lmbucket0/media/business_map/boost-mobile-ca-oxnard-1964-n-ventura-rd-93036.563a28fe746b.png)